January 20, 2022

Market Focus

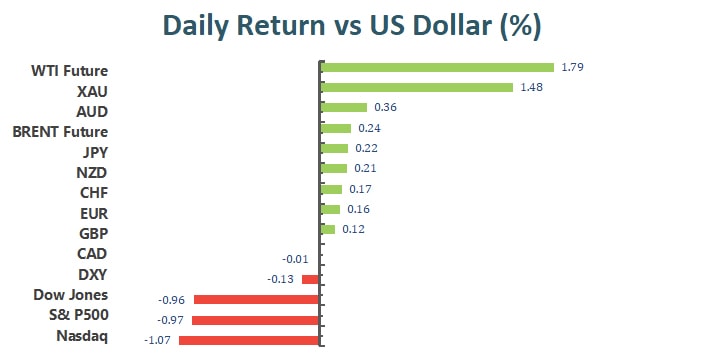

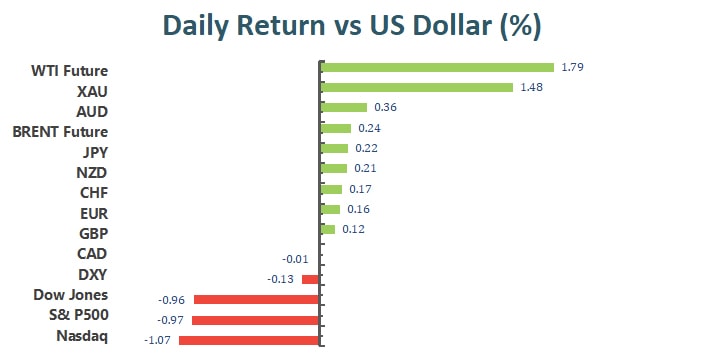

The broad U.S. equity markets continued to fall on Wednesday’s trading. The Dow Jones industrial average lost 0.96% to close at 35,028.65, the S&P 500 lost 0.97% to close at 4532.76, and the Nasdaq composite lost 1.15% to close at 14,340.25. The benchmark U.S. 10 year treasury yield continues to edge higher and is currently sitting at 1.865%; meanwhile, the 30 year treasury yield inched higher, as well, and is currently at 2.169%.

With earnings seasons well underway, Bank of America and Morgan Stanley have both reported better than expected earnings results; however, the broad equity market is already bracing for the Fed’s imminent rate hike. Among the 11 sectors that make up the S&P 500, only consumer staples and utilities were able to post moderate gains.

Meanwhile, the cryptocurrency market suffered as well. Bitcoin has fallen back below 42,000, more than a 35% drop from its November, 2021 high. Ethereum lost 2.53% against the Dollar and is currently trading at 3114.36.

Main Pairs Movement:

The Dollar Index, which measures the Greenback against a basket of major foreign currencies, dropped 0.11% over the course of yesterday’s trading.

Cable gained 0.13% over the course of yesterday’s trading. Britain’s CPI data indicated the largest inflationary pressure in nearly 30 years. Market participants interpreted this information as a possible trigger for the BOE increase interest rates once again.

The Euro gained against the Dollar amid broad-based Dollar weakness. With interest rate divergence on the horizon, upward momentum for the Euro remains weak.

The precious metal, Gold, enjoyed a 1.48% gain against the Dollar over the course of yesterday’s trading. With inflation rising, globally, market participants have once again turn to the precious metal as a hedge against inflation.

Technical Analysis:

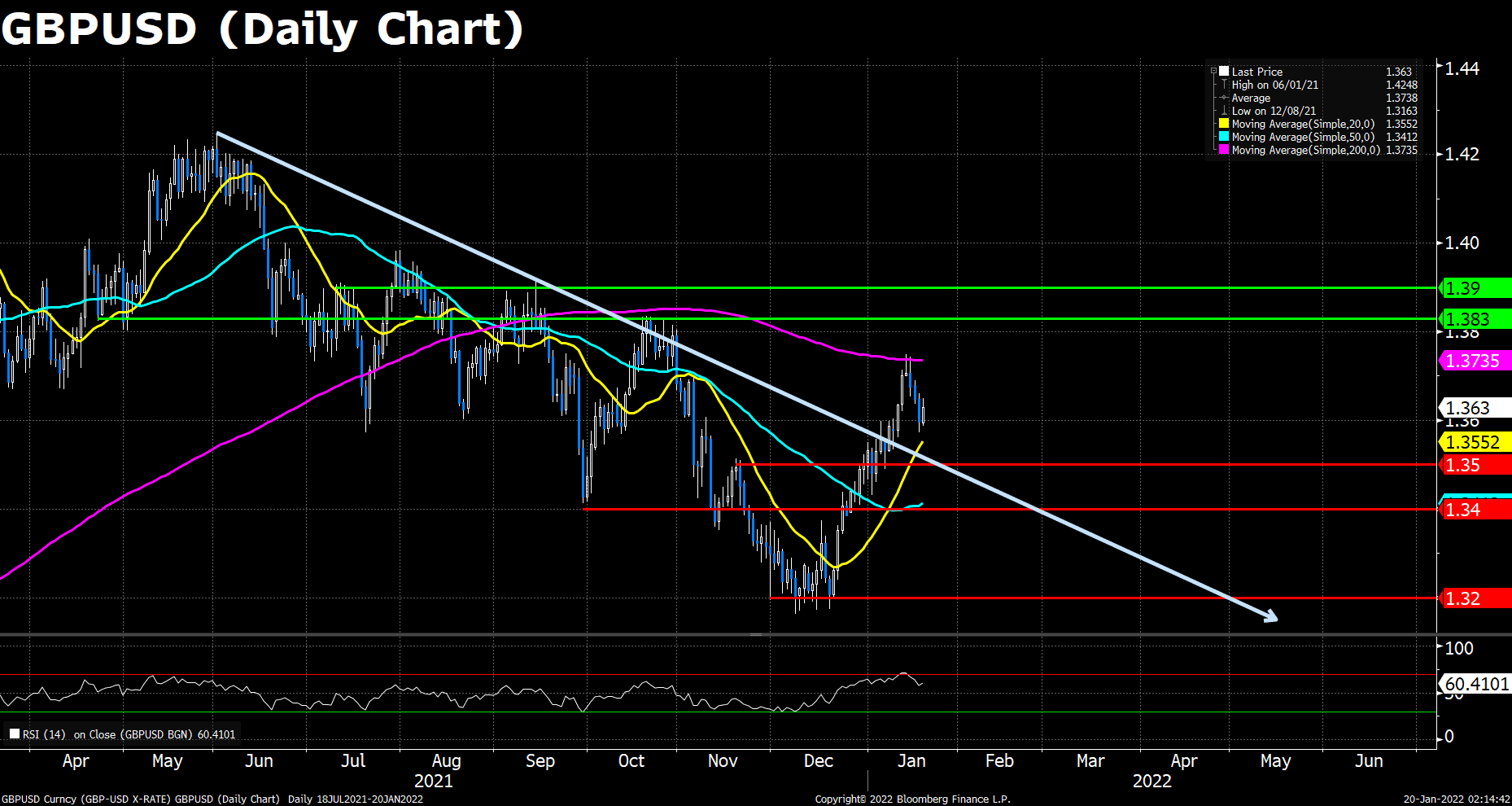

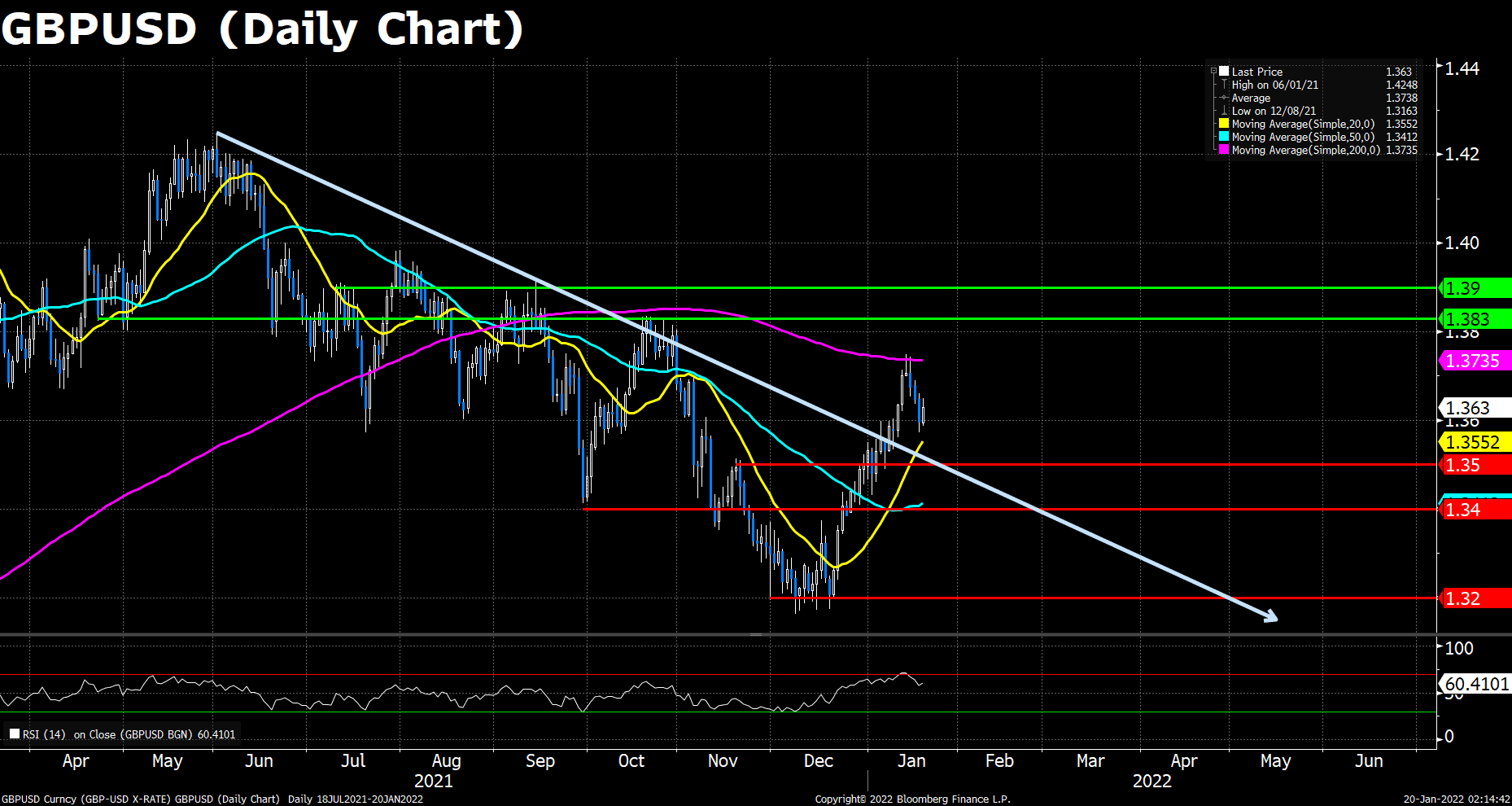

GBPUSD (Daily Chart)

Cable regained traction and rebounded on Wednesday, signaling an end of three-day retreat, triggered by a double rejection at 200 DMA (1.3736) last week. Sterling was boosted by UK CPI data which showed that inflation in Britain continued to rise and hit the highest level in nearly 30 years in December, hammering policymakers’ general view of transitory process and boosting hopes for another BoE’s rate hike on its February 3rd meeting.

On the technical front, owing to the fundamental supports, the RSI indicator bounced back to 60, suggesting a recovery in the bulls’ strength. Cable has jumped above the 1.3600 resistance and is heading to the critical 200 DMA pressure level at the moment. A breakthrough of that level indicates that there’s more room for Pound to appreciate, eyeing on 1.3830.

Resistance: 1.3736 (200 DMA), 1.3830, 1.3900

Support: 1.3500, 1.3400, 1.3200

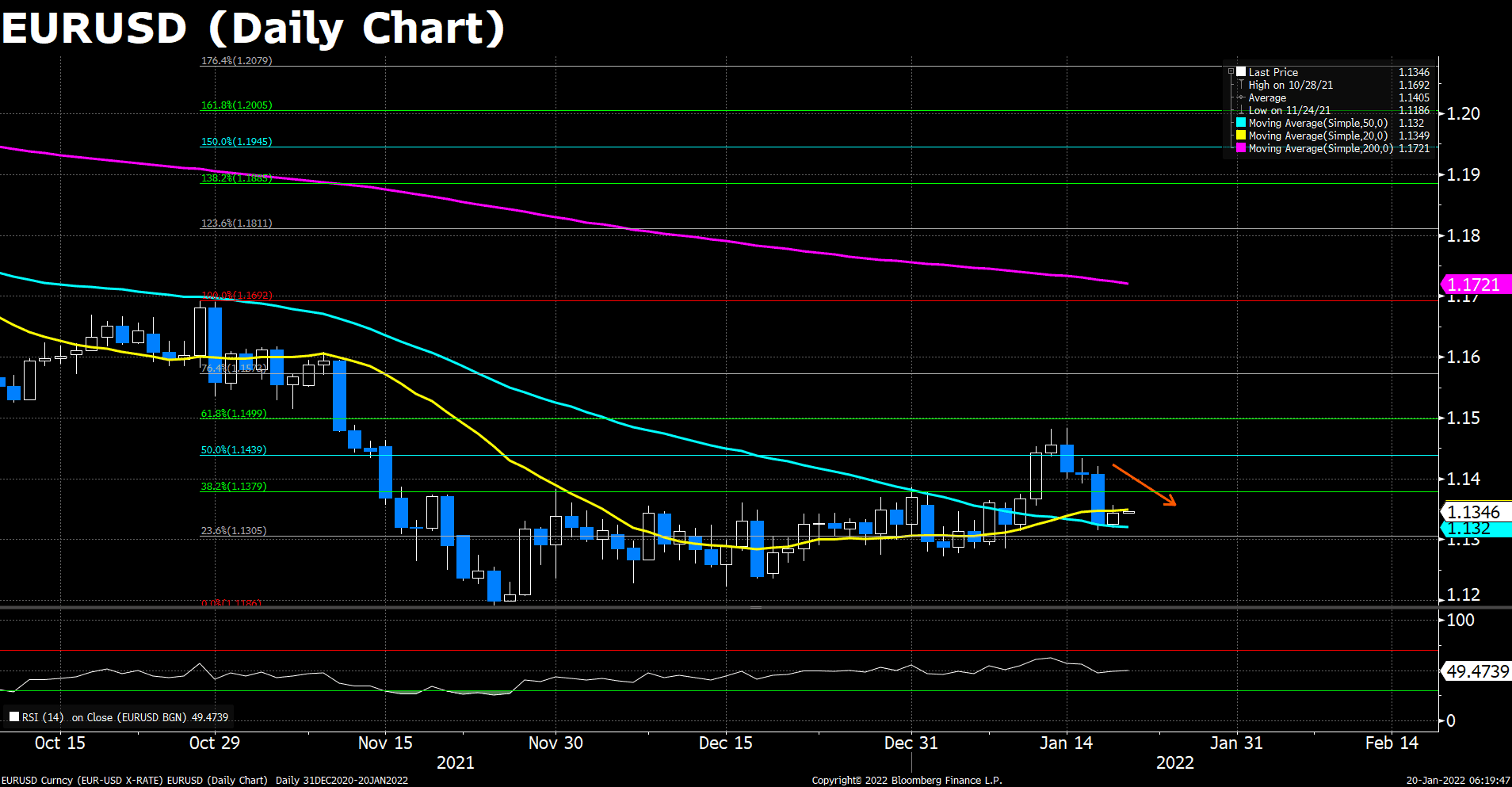

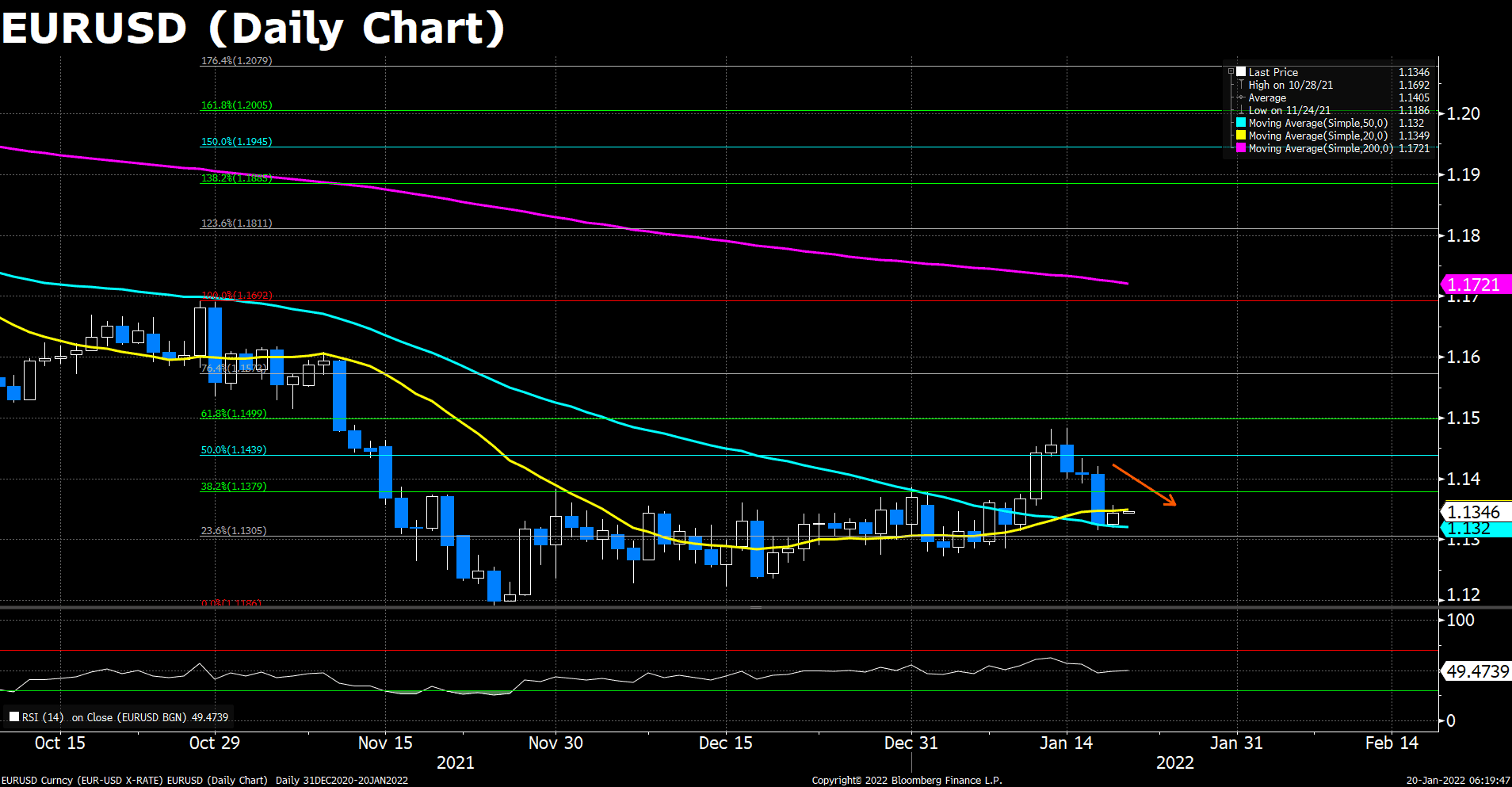

EURUSD (Daily Chart)

The EUR/USD pair is following its British peer’s rally with a modest 0.2% gain, which has barely regained about a quarter of its Tuesday’s decline. However, considering the weak outlook of the monetary policy divergences between the two central banks, and the risk of losses on Russia and Ukraine tensions, it is expected that the pair will eventually break under 1.1300 in the near term, and potentially post a fresh 2-year low as the Fed’s tightening cycle kicks off .

As to technical, the Euro pair doesn’t recover to the 38.2% Fibonacci during today’s trading, showing its intraday gains are nothing but a mild correction. The RSI for the pair marks 49.47, indicating the shared currency remain under selling pressure. To the downside, the pair could fell over the 1.1300 support and then season lows around the 1.1200 support. The pair still capped by its 20 and 200 DMA, slight above the 50 DMA.

Resistance: 1.1380, 1.1440,1.1500

Support: 1.1300, 1.1200

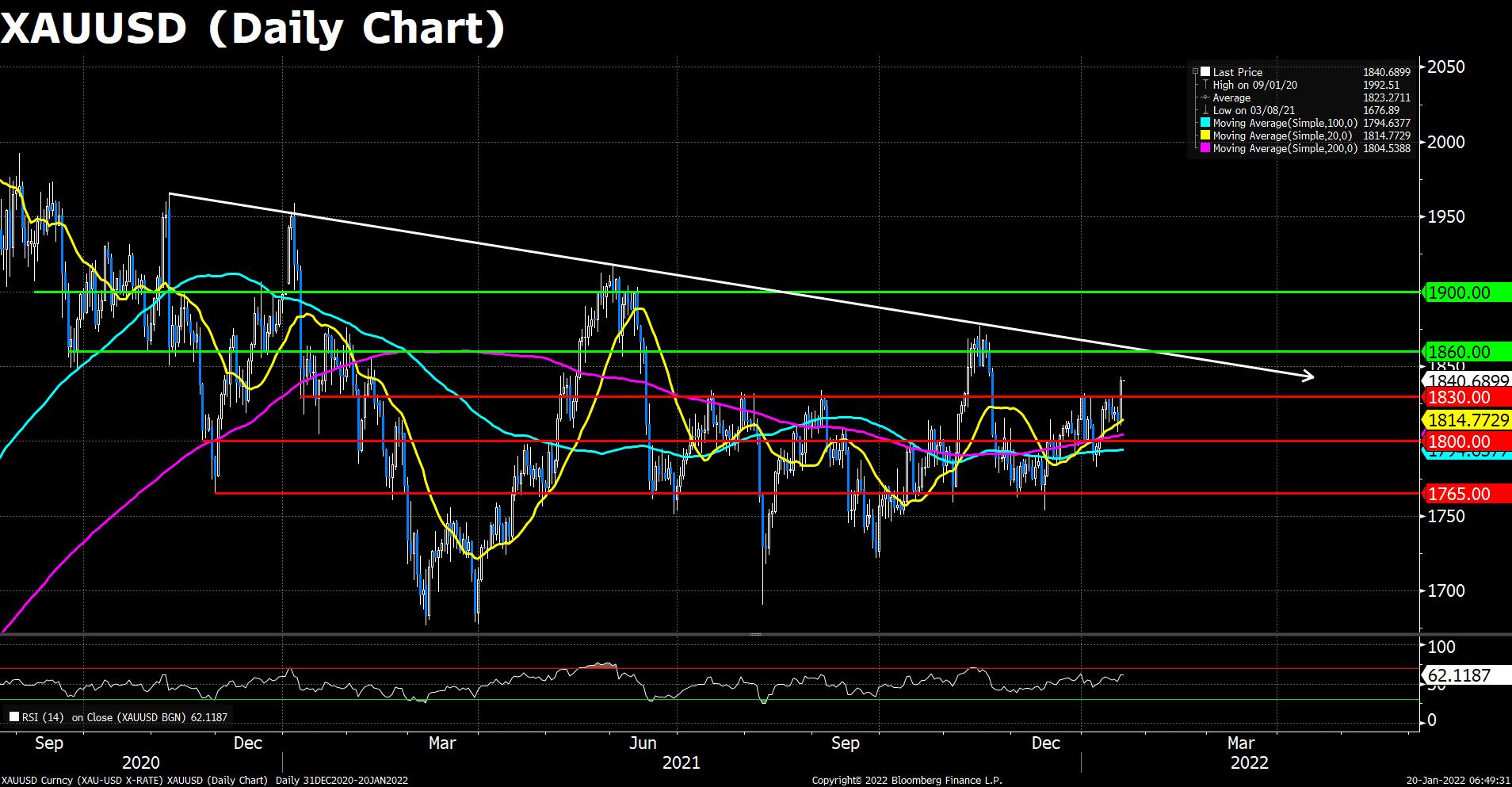

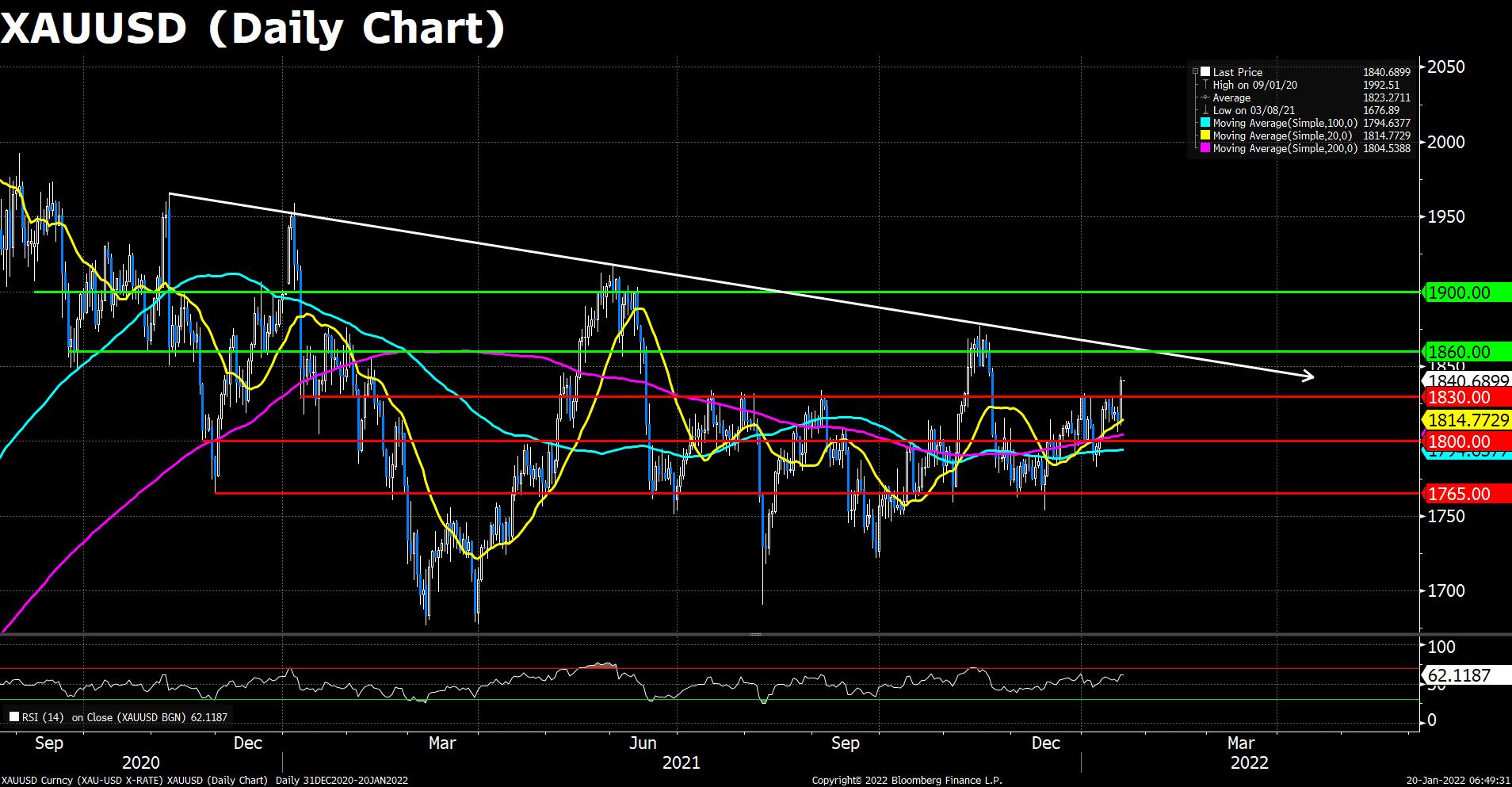

XAUUSD (Daily Chart)

Gold’s upside momentum has waned in recent trade, with prices trading in more of a subdued manner near $1842 after bursting above resistance in the $1830s for the first time in over two months. The speed of the pair’s latest advances, especially between the $1830 to $1840 area, is suggestive of a stop run, as many short traders may have had their stop loss sat somewhere in the $1830s. However, it is unlikely that spot gold can resist the advances of the US dollar and US real yields forever, and expectations for a very hawkish Fed in 2022 suggest continued upside risks for both.

From the technical perspective, though gold’s intraday hike, the pair’s mid-term bearish tractions are still above the price action. Gold price now trades above all its moving averages, and the RSI indicator reads 62.12, suggesting a bullish outlook. We expect the short-term uptrend to reach the critical $1,860 resistance, though the downside risk will get bigger and bigger during its climb.

Resistance: 1860, 1900

Support: 1830, 1800, 1765

Economic Data:

|

Currency

|

Data

|

Time (GMT + 8)

|

Forecast

|

|

AUD

|

Employment Change (Dec)

|

08:30

|

43.3 K

|

|

CNY

|

PBoC Loan Prime Rate

|

09:30

|

|

|

EUR

|

CPI (YoY) (Dec)

|

18:00

|

5.0%

|

|

EUR

|

ECB Publishes Account of Monetary Policy Meeting

|

20:30

|

|

|

USD

|

Philadelphia Fed Manufacturing Index (Jan)

|

21:30

|

220 K

|

|

|

USD

|

Initial Jobless Claims

|

21:30

|

20.0

|

|

|

USD

|

Existing Home Sales (Dec)

|

23:00

|

6.44 M

|

|