Daily Market Analysis

Market Focus

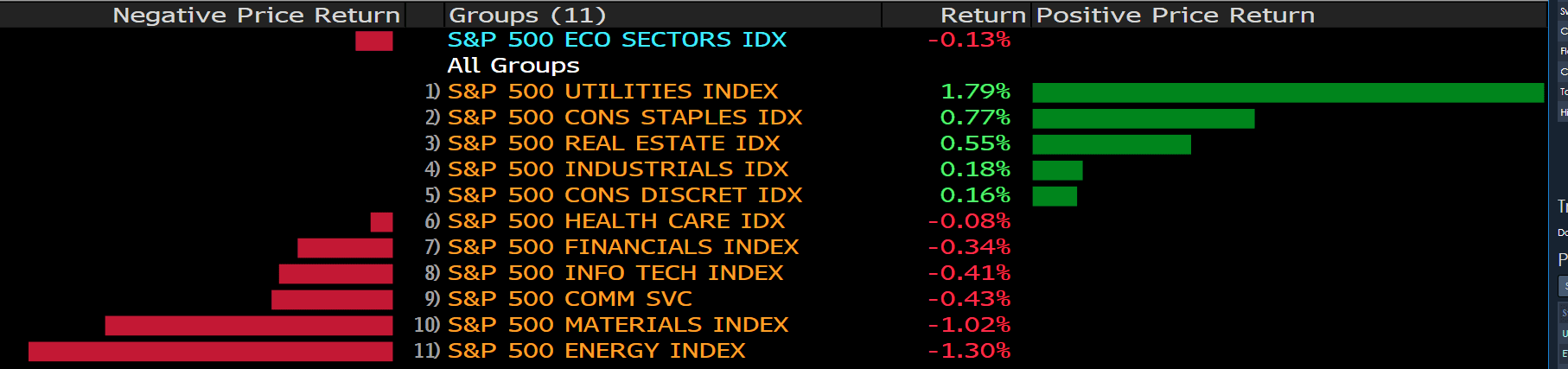

U.S. equities retreated as investors reassessed valuations in light of global economic risks including the spread of the Covid-19 delta variant and reductions in central bank stimulus.

The Nasdaq 100 was headed toward its biggest drop in two weeks, with losses in megacaps including Apple Inc. and Facebook Inc. contributing most to the decline. The S&P 500 fell for a third day since it closed at a record on Sept. 2. The Dow Jones Industrial Average extended its retreat from last month’s all-time high to more than 1.5%. Europe’s Stoxx 600 dropped to a three-week low. Cryptocurrency-exposed stocks slumped as a selloff in Bitcoin continued.

Wednesday’s declines came as money managers from Morgan Stanley to Citigroup have turned cautious on U.S. equities. Many investors have begun to see relative U.S. valuations as excessive even as growth elsewhere suffers from renewed Covid lockdowns and travel curbs. They doubt the world is ready for an eventual tapering of central-bank stimulus even as inflation accelerates due to supply shocks. End-of-year seasonality and valuation concerns are adding to the gloomy mood.

In Europe, growth concerns were compounded by speculation that the European Central Bank is getting ready to slow down emergency stimulus. Meanwhile, the continued spread of Covid-19 is curbing economic activity around the world. The Philippines backtracked on easing curbs in the capital region, while Japan may extend state of emergency orders. Taiwan identified a delta variant outbreak in New Taipei City.

Main Pairs Movement:

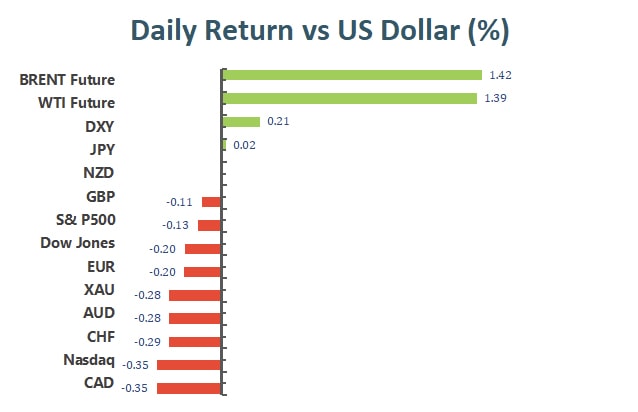

The recent rebound witnessed in US dollar continued on Wednesday, as greenback reached the highest level since August 27 during American session. The US dollar’s strength was mainly caused by the broader market risk sentiment, investors worried that the surge in delta variant cases around the world could obstruct the global economic recovery, therefore benefitted the safe-haven US dollar. The DXY index is at 92.662 as of writing, rising 0.15% on a daily basis. The greenback finds demand amid the souring market mood. Furthermore, US JOLTs Job Openings released on Wednesday gave a better-than-expected reading. And Fed’s John Williams also suggested that it’s appropriate to start tapering this year.

EUR/USD and GBP/USD both declined on Wednesday amid stronger US dollar across the board, trading at 1.1823 and 1.3780, respectively. EUR/USD was trading lower on Wednesday, once falling under 1.1805 level and posted a 0.12% loss on the day as of writing. Market focus now shifts to the European Central Bank’s interest rate decision on Thursday.

USD/JPY edged lower today, as the pair failed to preserve its upward traction in early trade and took a hit right after the European session began. The pair is trading at 110.23 and posted a 0.02% loss on the day as of writing.

Gold slipped on Wednesday, as the bearish momentum last for the third consecutive day. The raising demand of US dollar and a risk-off environment keep putting selling pressure on gold. The precious metal is now trading at 1788.82, losing 0.29% on a daily basis. WTI Crude Oil, on the contrary, soared more than 1.4% on Wednesday.

Technical Analysis:

GBPUSD (4-hour Chart)

The GBP/USD pair declined on Wednesday, touching a fresh weekly low during European trading hours. Despite trying to bounce back above 1.3790, it is still lower for the day. The cable was last seen trading at 1.3777, losing 0.06% on the day as of writing. The recent rally in US dollar keep weighing on the British Pound. Meanwhile, British Prime Minister Boris Johnson plans to introduce a new 1.25% health and social-care levy on earned income, which also limit any meaningful recovery for the GBP/USD pair.

For technical aspect, RSI indicator 42 figures as of writing, suggesting tepid bear-movement ahead. The MACD indicator also shows a negative histogram which indicates a bearish signal. In conclusion, we think market will be bearish. But for the Bollinger Bands, price seems to rise back inside the band after falling out of the lower band, therefore, invstors should look for signs of trend reversal.

Resistance: 1.3857, 1.3892, 1.3958

Support: 1.3731, 1.3680, 1.3602

USDCAD (4- Hour Chart)

The USD/CAD pair advanced on Wednesday, reaching the highest level since August 23 for a time. The pair rallied after the BoC interest rate decision was released, but then slipped deeper back to 1.2648, eliminating most of its profits. The pair is trading at 1.2670 at the time of writing, posting a 0.19% gain on a daily basis. The Bank of Canada decided to keep its overnight rate unchanged at 0.25% and the QE program is also maintained at C$ 2 billion per week. The dovish monetary policy provide some positive momentum for the USD/CAD pair.

For technical aspect, RSI indicator 68 figures as of writing, suggesting the buying power is relatively stronger. The MACD indicator also shows a positive histogram which indicates a bull market. In conclusion, we think market will be bullish as the pair heads to test the 1.2708 resistance, a break above that level will open the door for additional near-term profits. The next resistance sits at 1.2834.

Resistance: 1.2708, 1.2834, 1.2949

Support: 1.2581, 1.2520, 1.2494

AUDUSD (4- Hour Chart)

The AUD/USD pair was trading higher in early trade on Wednesday, but the bullish momentum didn’t last long. The pair dropped to fresh seven-day low and dipped further during American session. A stronger US dollar across the board leaves the AUD/USD pair in the negative territory. On top of that, the RBA released its interest rate decision on Tuesday, as they kept the benchmark interest rate at 0.1%, same as market’s forecast. But the delta outbreak made the central bank decide to extend the bond purchases, which weighed on the Australian dollar. At the time of writing, the pair is trading at 0.7379, losing 0.06% on the day.

For technical aspect, RSI indicator 43 figures as of writing, suggesting tepid bear-movement ahead. The MACD also falls below the signal line, which means the pair is likely to experience downward momentum. In conclusion, we think market will be bearish as the pair is now testing the 0.7356 support. For Bollinger Bands, the price is now sitting between the moving average and the lower band, which also indicates a bear market.

Resistance: 0.7468, 0.7534

Support: 0.7356, 0.7285, 0.7222

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

EUR |

Deposit Facility Rate (Aug) |

19:45 |

-0.50% |

||||

|

EUR |

ECB Marginal Lending Facility |

19:45 |

|||||

|

EUR |

ECB Monetary Policy Statement |

19:45 |

|||||

|

EUR |

ECB Interest Rate Decision (Aug) |

19:45 |

|||||

|

USD |

Initial Jobless Claims |

20:30 |

335K |

||||

|

EUR |

ECB Press Conference |

20:30 |

|||||

|

USD |

Crude Oil Inventories |

23:00 |

-4.612M |

||||