November 23, 2021

Market Focus

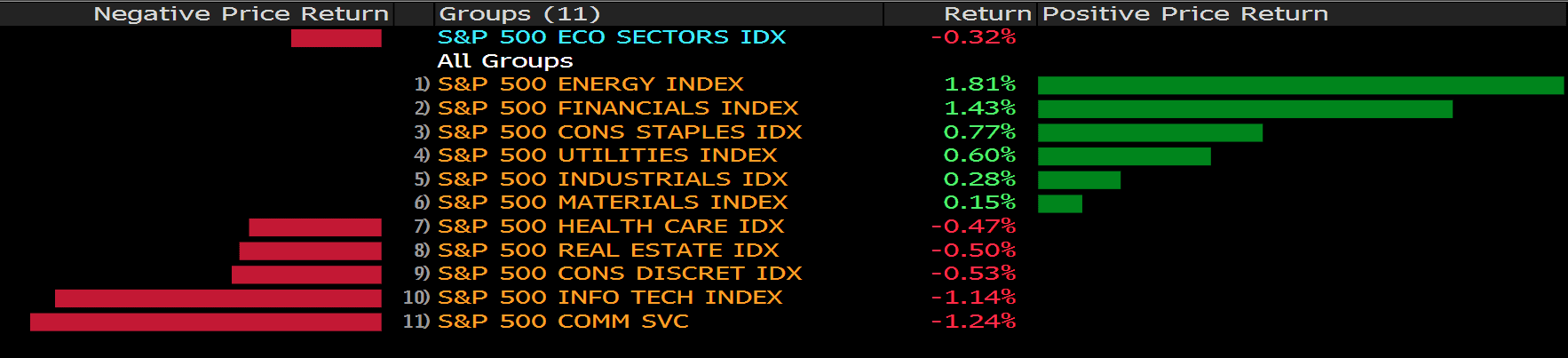

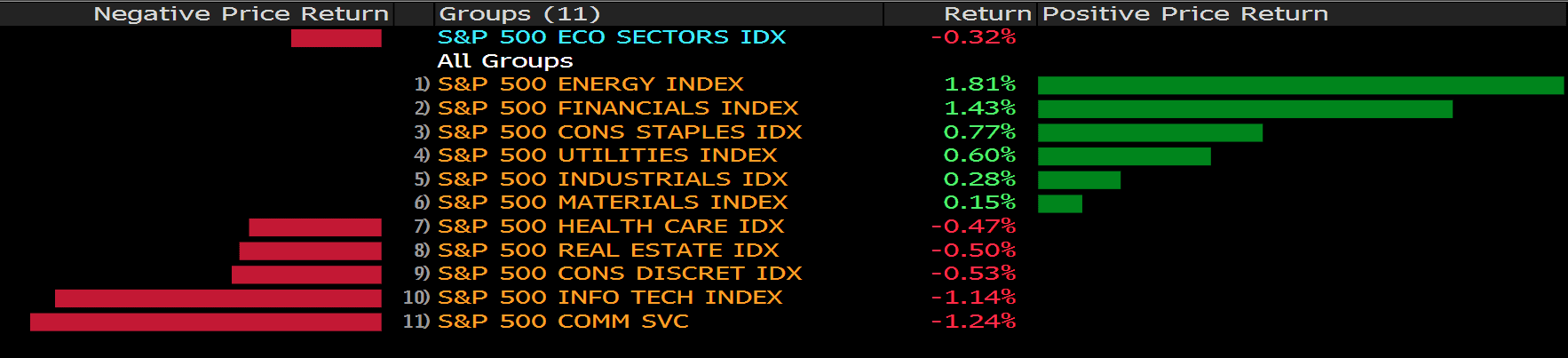

As investors cheered on the appointment of Federal Reserve Chairman Jerome Powell for the second term, U.S. stocks rose to a record high, and the S&P 500 index surged to a high of the day immediately after the opening of the U.S. market. However, the S&P 500 Index closed lower on Monday as Wall Street Bank expects to raise interest rates in 2022. In addition, rising U.S. Treasury yields put pressure on major growth stocks such as Amazon and Alphabet, which fell -2.83% and -1.92% respectively. Moreover, following the surge in US Treasury yields, the S&P 500 Bank Index rose, as investors investors priced in tighten policy in the first half of 2022. Wells Fargo Bank (WFC.N) is one of the strongest banks on Wall Street.

At the close of the market, the S&P 500 Index fell 15.38 points or 0.32% to close at 4,682.88 points, the Nasdaq Composite Index fell 202.68 points or 1.26% to 15,854.76, and the Dow Jones Industrial Average rose 17.28 points, or 0.05%, to 35,617.83.

Tesla is also one of the biggest gainers, rising 1.74%. Earlier on Monday, Tesla CEO Elon Musk said on Twitter that Model S Plaid may arrive in China “around March.”

Main Pairs Movement:

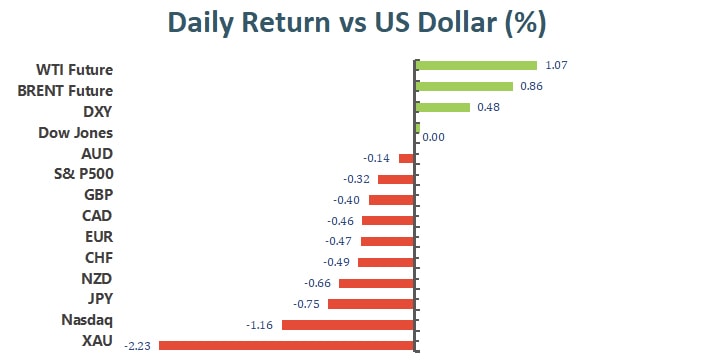

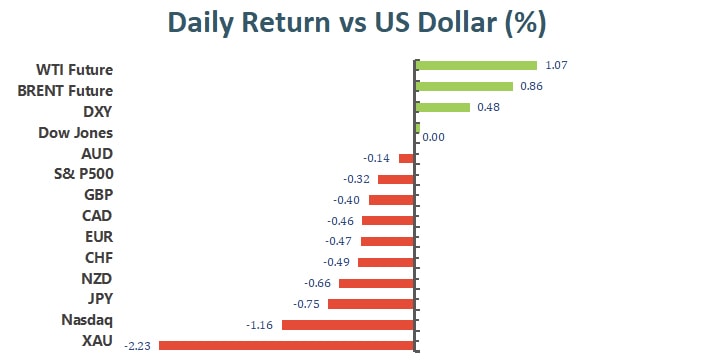

The US dollar led the way and became the overall winner. In 2021, it set a new high against the euro and a multi-month high against other major competitors. Most of the strength of the dollar comes from US President Joe Biden, who nominated Jerome Powell for re-election as chairman of the Federal Reserve.

The US 10-year bond yield finally rose by nearly 9 basis points to 1.62% in intraday trading. The current yield has returned to its highest level since last Wednesday, and is currently only about 3 basis points lower than last week’s high of 1.65%. With the rise in yields, the US dollar index has also continued to roll to the year’s high of 96.502, and its upward trend seems to be endless.

The EUR/USD is currently hovering near 1.12400 and is in a sharp downward trend because it continues to suffer from the severe wave of Covid19, and the dovish state is also the main key to the weakness.

The price of gold plummeted due to the strengthening of the U.S. dollar, trading at $1,803.00 per ounce. Crude oil prices are rising, and WTI is currently hovering around US$76.70 per barrel.

Technical Analysis:

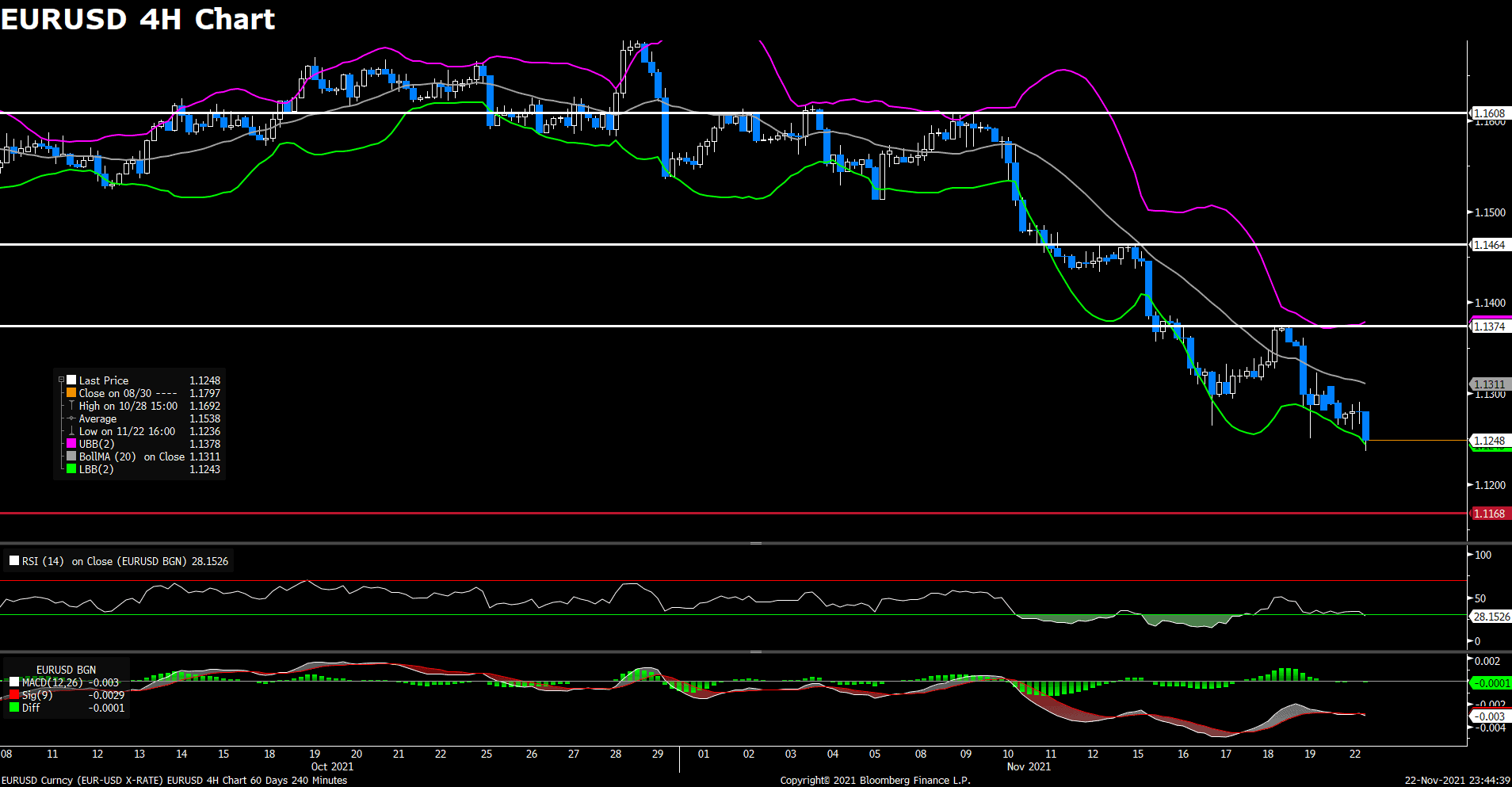

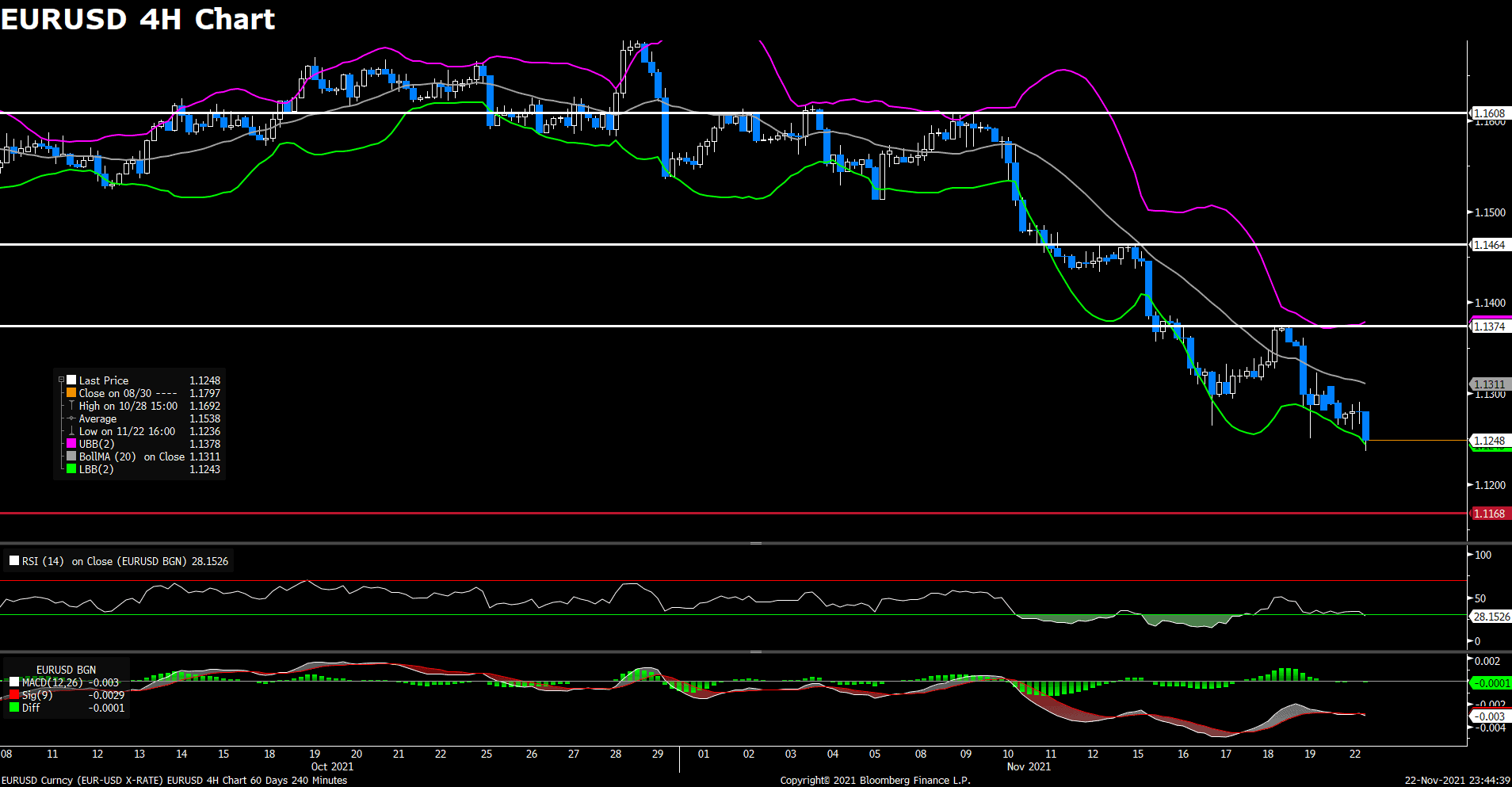

EURUSD (4- Hour Chart)

After touching the lowest level since July 2020 under 1.126 level, the pair EUR/USD continue its bearish traction on Monday amid US dollar strength. The pair flirted with 1.128 level most of the day, but then dropped towards 1.124 area, currently losing 0.14% on a daily basis at the time of writing. White House announced on Monday that Federal Reserve Chair Jerome Powell was nominated for a second four-year term by President Joe Biden. The news provided strong support to the US dollar and sent the DXY index above 96.4 level. In Europe, concerns about rising Covid-19 cases acted as a headwind for the Euro, as some countries in Europe may reimpose a full lockdown or bring back restrictions to tackle rising infections.

For technical aspect, RSI indicator 30 figures as of writing, suggesting that the pair is in oversold zone, a trend reversal could be expected. Looking at the Bollinger Bands, the price is moving alongside with the lower band, therefore the downward trend is likely to persist. In conclusion, we think market will be bearish as the greenback’s strength still remained by hawkish Fed expectations. A potential move lower towards 1.1200 seems possible as the pair has broken the previous support.

Resistance: 1.1374, 1.1464, 1.1608

Support: 1.1168

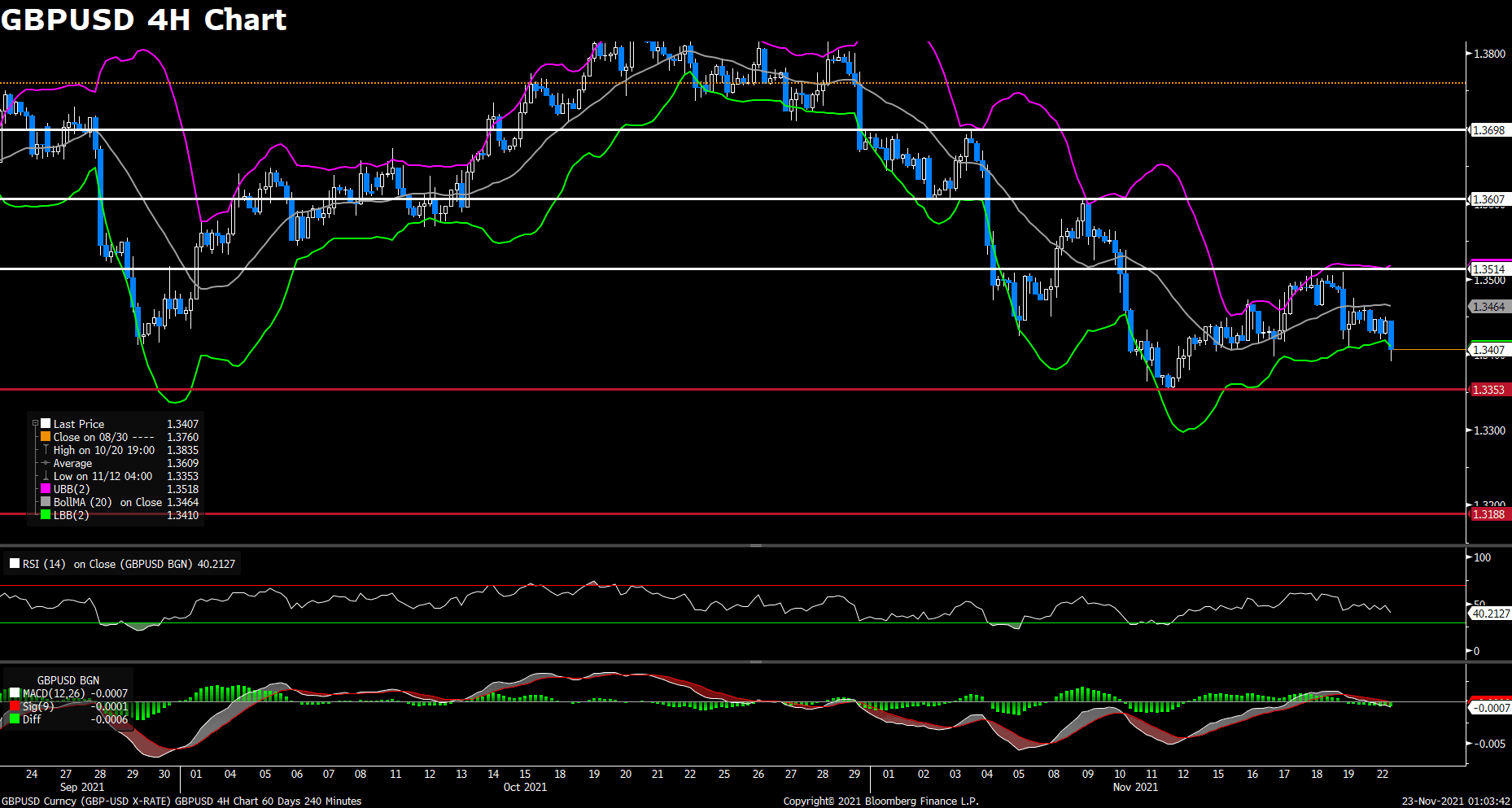

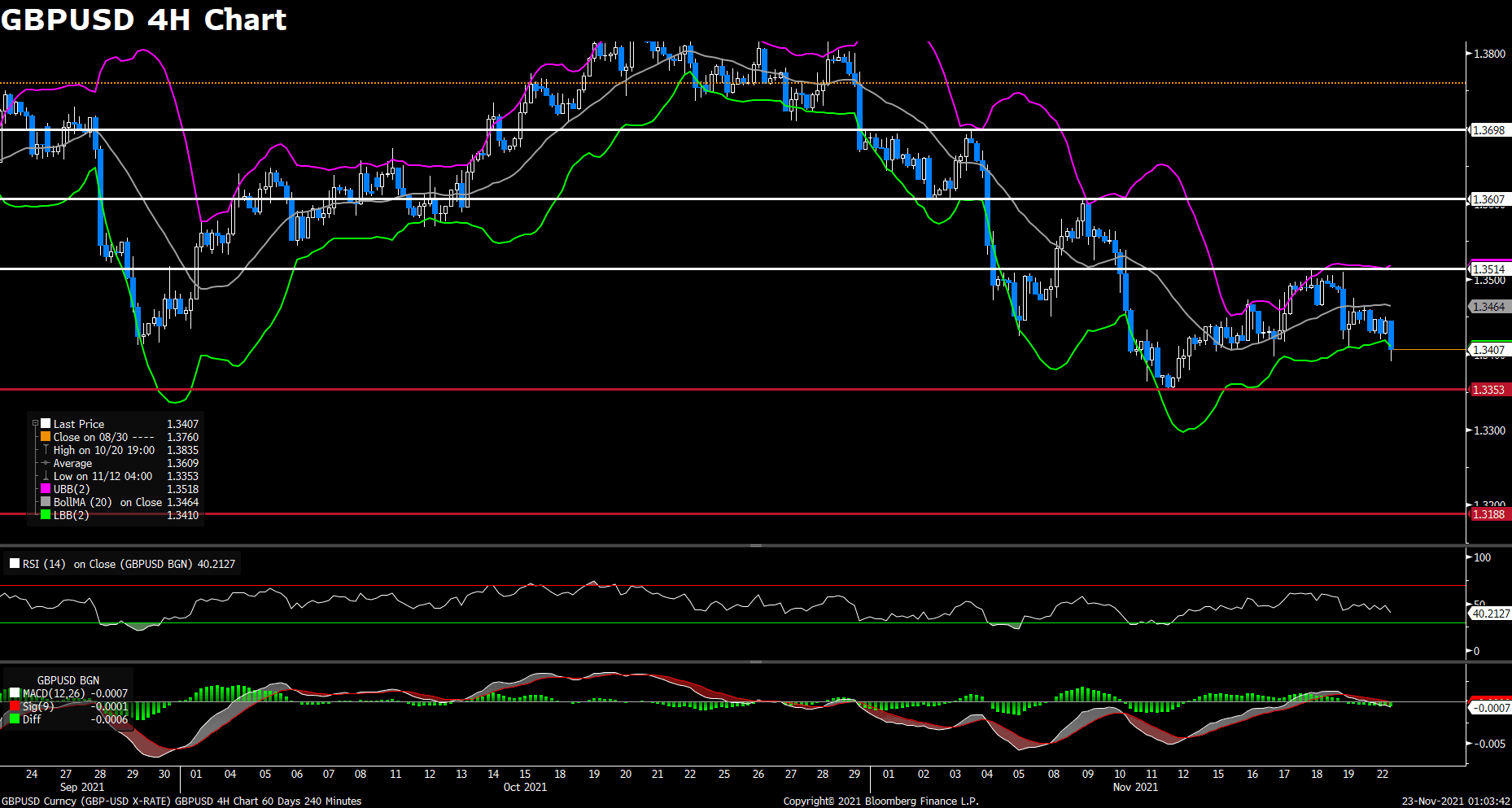

GBPUSD (4- Hour Chart)

Following last Friday’s slide, the pair GBP/USD declined for the second day on Monday. The pair was trading in a range near 1.344 area during Asian and early European session, but started to see heavy selling after the announcement of Powell’s renomination as Fed chair. The cable rebounded slightly after touching a two-week low, currently losing 0.28 on a daily basis. The latest dovish comment from BoE governor Andrew Bailey over the weekend put some downward pressure on the GBP/USD pair. Moreover, the deadlock over the post-Brexit arrangement in Northern Ireland and fishing rights continued acting as a headwind for the British pound.

For technical aspect, RSI indicator 41 figures as of writing, suggesting tepid bear movement ahead. Looking at the MACD indicator, the MACD is now sitting below the signal line, which means a downward trend for the pair. As for the Bollinger Bands, the price moved out of the lower band, therefore a strong trend continuation could be expected. In conclusion, we think market will be bearish as the pair is eyeing a test of the next support, which is at 1.3353. Given that there isn’t any major market-moving UK macro data today, investors await Tuesday’s UK PMI reports for trading impetus.

Resistance: 1.3514, 1.3607, 1.3698

Support: 1.3353, 1.3188

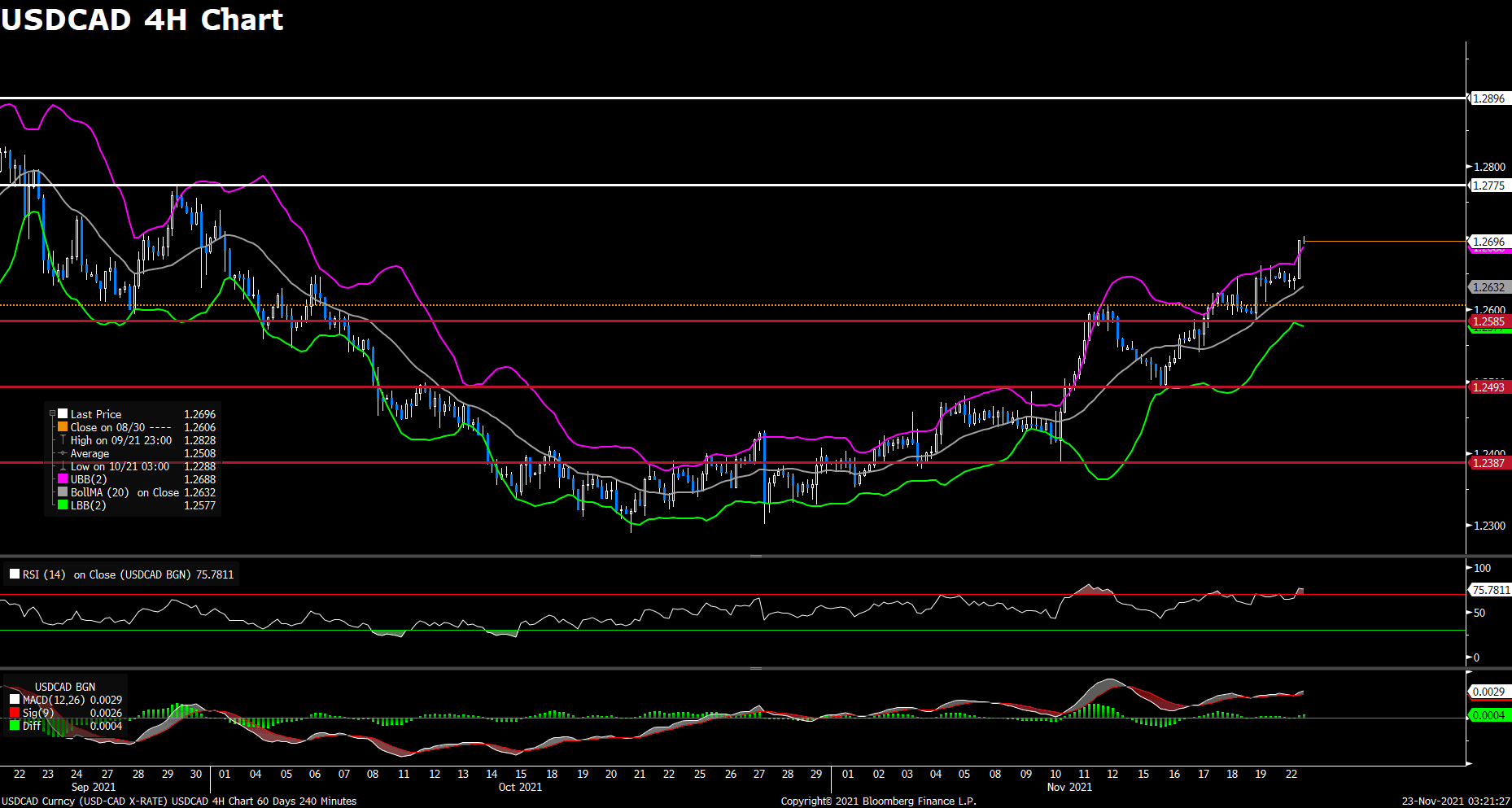

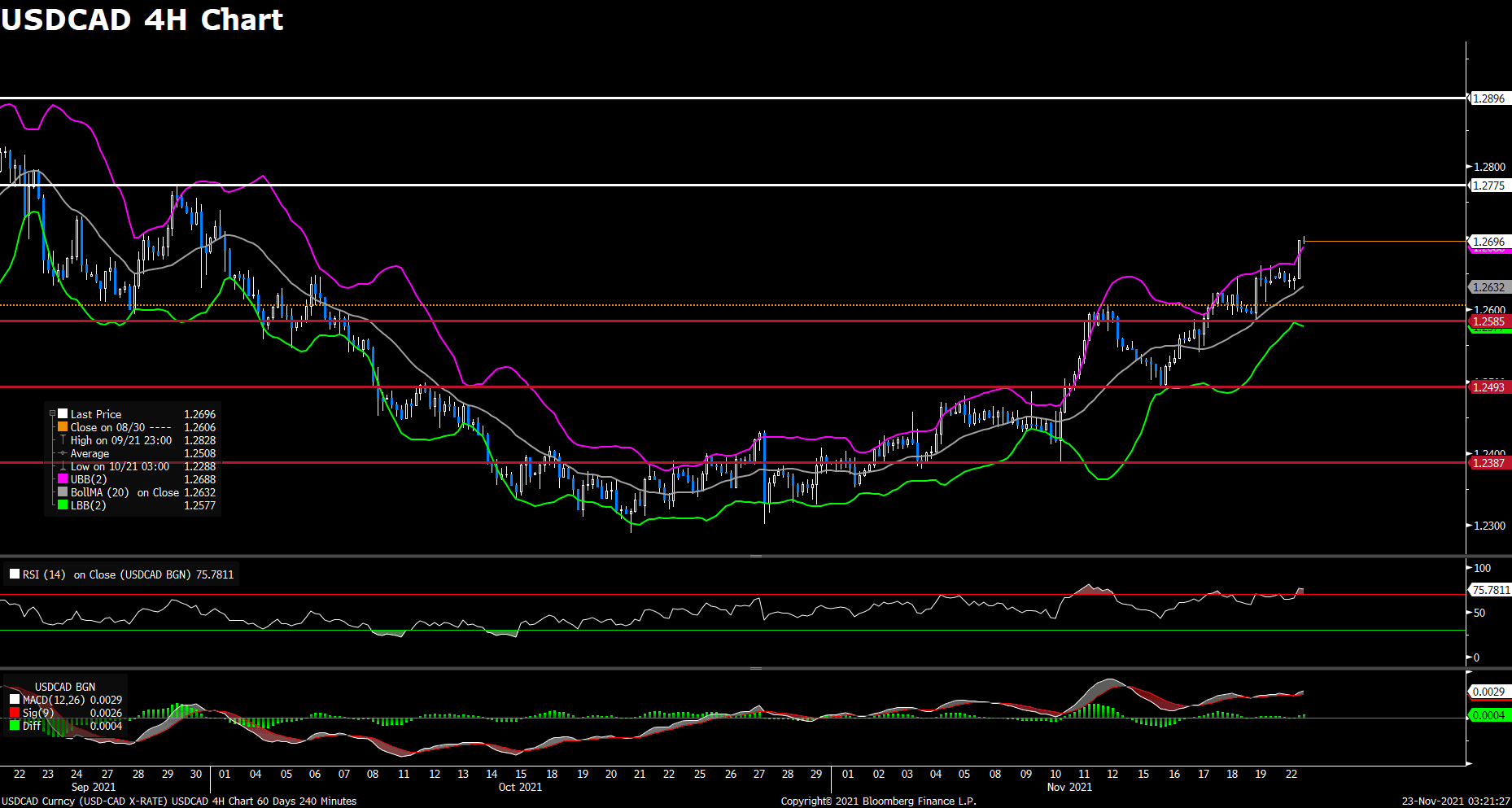

USDCAD (4- Hour Chart)

After a five-day rebound from 1.25 area, the pair USD/CAD climbed higher on Monday amid stronger US dollar across the board, now targeting at 1.27 level. The pair jumped to a monthly top after Powell’s renomination, paring its initial intraday losses. USD/CAD was last seen trading at 1.2695, currently posting a 0.45% gain on a daily basis. Even though WTI crude oil has risen 1.15% for the day, the resurging oil prices failed to underpinned the commodity-linked loonie. On top of that, expectations that the Fed will hike rates by the middle of 2022 also acted as a tailwind for the pair, as hawkish Fed speculations were reinforced by elevated US Treasury bond yields.

For technical aspect, RSI indicator 75 figures as of writing, suggesting that the pair is near overbought zone, a trend reversal could be expected. But looking at the MACD indicator, the MACD is now sitting above the signal line, which means that upward trend could persist. As for the Bollinger Bands, the price moved out of the upper band, therefore a strong trend continuation could be expected. In conclusion, we think market will be bullish as the pair already broke the previous 1.2648 support, a break above 1.2775 could intensify the bullish tone.

Resistance: 1.2775, 1.2896

Support: 1.2585, 1.2493, 1.2387

Economic Data

|

Currency

|

Data

|

Time (GMT + 8)

|

Forecast

|

|

EUR

|

German GDP (QoQ) (Q4)

|

15:00

|

2.2%

|

|

EUR

|

German Manufacturing PMI (Nov)

|

16:30

|

56.9

|

|

GBP

|

Composite PMI (Oct)

|

17:30

|

54.1

|

|

GBP

|

Manufacturing PMI (Oct)

|

17:30

|

56.3

|

|

GBP

|

Services PMI (Oct)

|

17:30

|

54.6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|