January 15, 2021

Daily Market Analysis

Market Focus

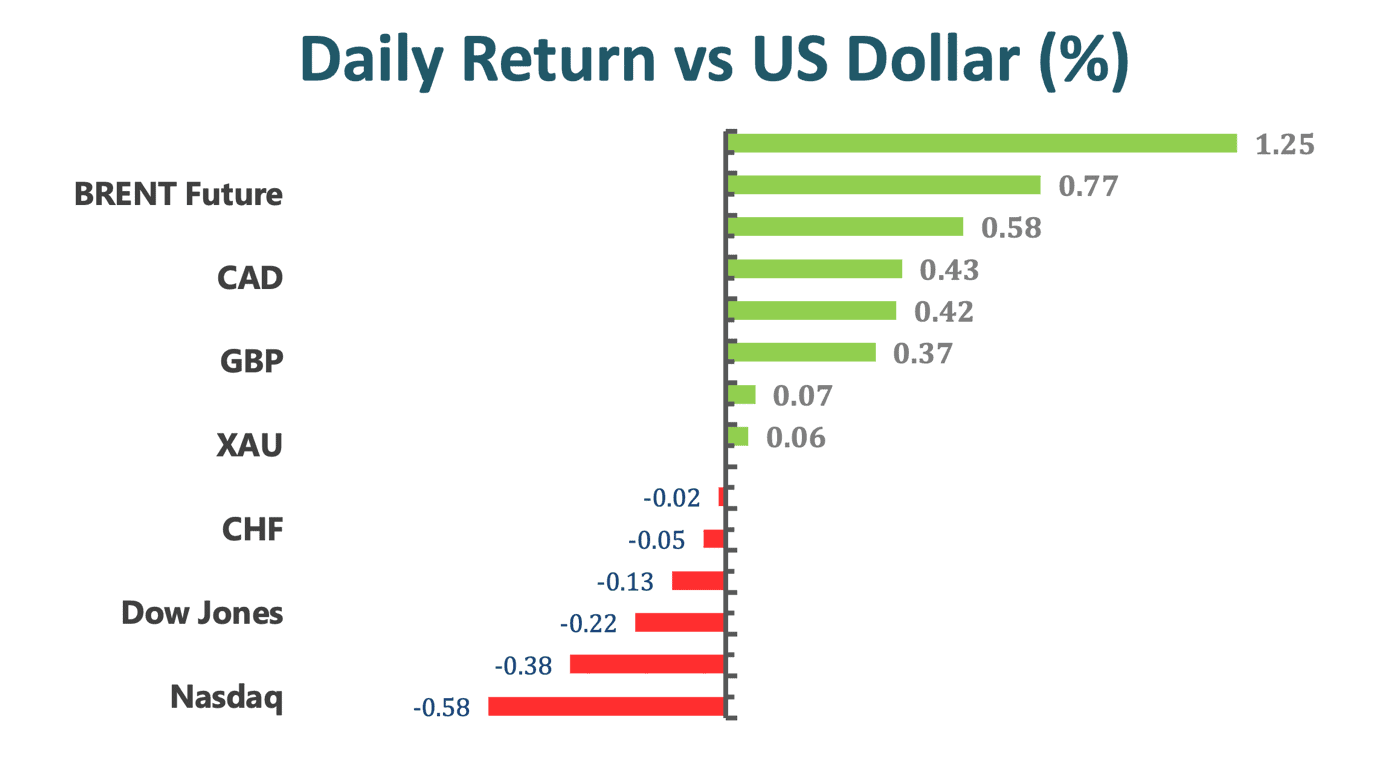

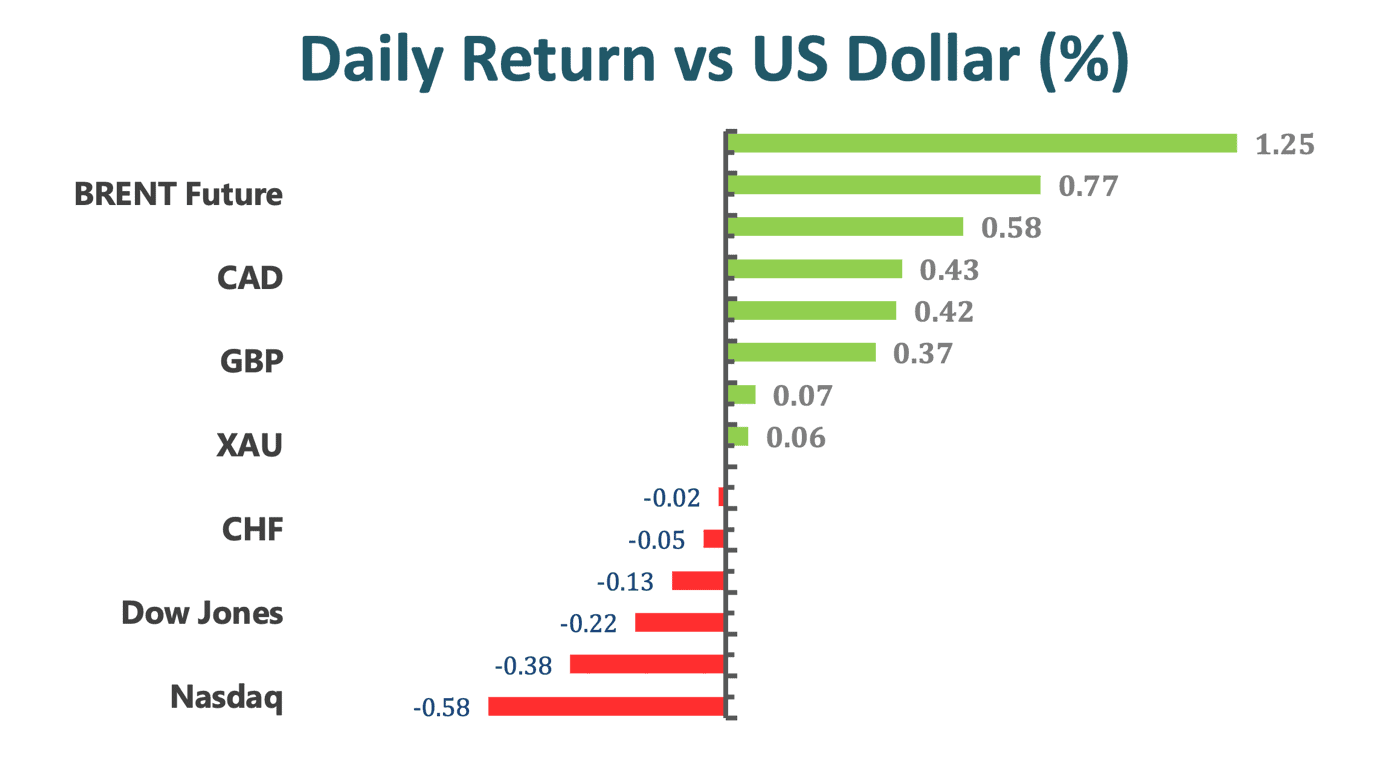

US stocks fell for the first time in three days and Treasury yields climbed amid expectations of President-elect Joe Biden planning another round of Covid-19 relief of as much as $2 trillion. After approaching all-time highs most of Thursday, the S&P500 turned negative late in the trading session. Technology, communication services and consumer discretionary sectors were the biggest losers, while energy shares rose with oil. Biden is expected to announce his economic support plans later in the day. Federal Reserve Chairman Jerome Powell said policy makers won’t raise interest rates unless they see troubling signs of inflation. On top of that, the Fed Chair Powell held a brief Q&A event at Princeton University and spent most of his time in the discussion to address the Fed’s decision made during pandemic.

The five key takeaways from Powell’s remarks at Princeton Finance Event:

1.The Fed chair said that, with regard to the central bank’s bond-buying program, “now is not the time to be talking about exit.” He added that “the economy is far from our goals,” and that “when it does become appropriate for the committee to discuss specific dates” for tapering of purchases, it would be done “well in advance”.

2.Powell downplayed the inflation that forecasters expect to see in the US this year. When asked about it, he focused his answer on the job market instead and the amount of damage that will need to be repaired on that front, reinforcing the dovish tilt to the Fed’s current policy stance.

3.Powell brushed off various concerns the moderator raised about corporate and public leverage, suggesting those wouldn’t affect the Fed’s interest-rate decisions.

4.The Fed chair also gave a post-mortem of sorts on the central bank’s emergency lending facilities that were launched in the early days of the pandemic and shuttered at the end of 2020. He had high praise for the corporate and municipal bond market backstops, whereas the Main Street Lending Program he admitted had some important conceptual flaws.

5.Powell also discussed how the Fed can contribute to the fight against inequality, an insight that emerged from the policy framework review the Fed conducted over the course of 2019 and much of 2020. Expect to hear more from Fed officials on that in the coming years as it plays into their assessments about how close the economy is to their goal of maximum employment.

Market Wrap

Main Pairs Movement

EURUSD is currently trading at 1.1257 having travelled between a range of 1.2111 and 1.2179 on the day so far, catching a bid on Federal Reserve Jerome Powell’s remarks. GBPUSD extended its rally in the second half of the day and touched its highest level since May 2018 at 1.3709. The broad-based selling pressure surrounding the greenback continues to fuel the pair’s upside. After dropping below 0.7750 in the early American session, the Aussie turned north supported by the broad selling pressure surrounding the greenback.

The US dollar index flirts with tops near 90.65, then retreated down to the 90.240 region post Powell’s comments. WTI crude oil currently trades flat during what has thus far been choppy directionless trade. Front-month WTI futures currently trade just beneath the $53.00 level as market await key Biden speeches.

Technical Analysis:

USDJPY (4 Hour Chart)

USDJPY erases most of its gains from the two-consecutive-day win streak of the pair at the time of writing. Despite the bulls’ efforts to push USDJPY to its weekly high near 104.20 in the earlier session, the dollar still slides substantially after the markets processed the highly anticipated Fed Chair Powell’s comments at Princeton Finance Event. The major dragging force that weighs on the greenback was Powell’s comment on the forecasted inflation across the U.S. economy. According to Powell, the central bank won’t hike until it sees troubling inflation or imbalances. Additionally, he mentioned that he could see upward pressure on prices near-term, but bank has tools to quell unwelcome price gains. Finally, he focused on the job market, rather than on the amount of damage that would need to be repaired to reinforce the dovish stance the Fed is currently upholding.

Powell’s comments greatly impacted the fluctuations of most USD rivals, one in particular is the USDJPY as the pair turned south at 104.13 and bottomed near 103.55. From a technical perspective, the comments of Powell has inevitably turned the RSI neutral, but the support at 103.65 has offered some crucial cushion for the bulls to catch a breath. The 21-Day SMAVG is still signaling a bullish trend for the pair; however, the bulls must first find acceptance above the 104 resistance level to resume its bullish momentum.

Resistance: 104.00, 104.25

Support: 103.65, 103.55, 103.42

USDCAD 4 Hour Chart)

Backed by the strong performance of the Oil, the CAD continues to exert its dominance over the USD on Thursday with the Loonie pair currently trading around the weekly low near 1.2630. Not to mention the fact that the comments made by Fed Chair also contributed to the breakthrough of the Loonie below the numerously tested support at 1.2670. Technically speaking, the break below the crucial support 1.2670, which has turned into the most immediate resistance for USDCAD, officially marked a death cross on the SMAVG, indicating that the Loonie is about to head further south. If the Loonie break below the support at 1.2630, the next cushion would be seen at 1.2546, a price that was last seen in 2018 Apr. Given that the RSI is now bouncing around 37, it is inferable that while an upward correction may be around the corner, there is still room for USDCAD to dip before staging an positive correction.

Resistance: 1.2670, 1.2705, 1.2745, 1.2840

Support: 1.2630, 1.2546

XAUUSD (4 Hour Chart)

The gold traders experience a roller-coaster type of day as the XAUUSD first dove drastically from the high of $1852 to $1829, then rose extensively post Powell’s comments to the daily high above $1857, and the yellow metal has now retreated back down to $1846. The next most heavily anticipated event is US President-elect Joe Biden’s reveal of the next fiscal stimulus plans (this should take place at 00:15 GMT). Currently, one possible plan is a larger than $2.0 trillion bill that is likely to include a significant child benefit spending but might not be supported by Biden’s Republicans counterparts in Senate. Now, given that Biden would need 60 votes in the Senate to pass the bill, as a result, the markets are heavily eyeing an alternative bill.

From a technical perspective, the XAUUSD is still on a bearish trend as indicated by the strong 60-Day SMAVG and the RSI. Additionally, as the MACD line is now staging a cross below its signal line, the bearish momentum is further confirmed. If XAUUSD drops below the most immediate support near $1839, the next support would be $1827, then $1815. Conversely, if the weakened greenback persists and pushes the XAUUSD up, the first resistance the bulls would have to break would be found at $1856, followed by $1863 and $1879.

Resistance: 1856, 1863, 1879

Support: 1839, 1827, 1815

Economic Data

|

Currency

|

Data

|

Time (TP)

|

Forecast

|

|

USD

|

Fed Chair Powell Speaks

|

01.30

|

N/A

|

|

GBP

|

GDP (MoM)

|

15.00

|

N/A

|

|

GBP

|

Manufacturing Production (MoM)(Nov)

|

15.00

|

0.9%

|

|

GBP

|

Monthly GDP 3M/3M Change

|

15.00

|

N/A

|

|

USD

|

Core Retail Sales (MoM)(Dec)

|

21.30

|

-0.1%

|

|

USD

|

PPI (MoM)(Dec)

|

21.30

|

0.4%

|

|

USD

|

Retail Sales (MoM)(Dec)

|

21.30

|

-0.2%

|

|

|

|

|

|

|

|

|