Avis d’ajustement des dividendes – Mar 31 ,2025

Cher Client, Veuillez noter que les dividendes des produits suivants seront ajustés en conséquence. Les dividendes des indices seront exécutés …

Dos

Dos

Dear Client,

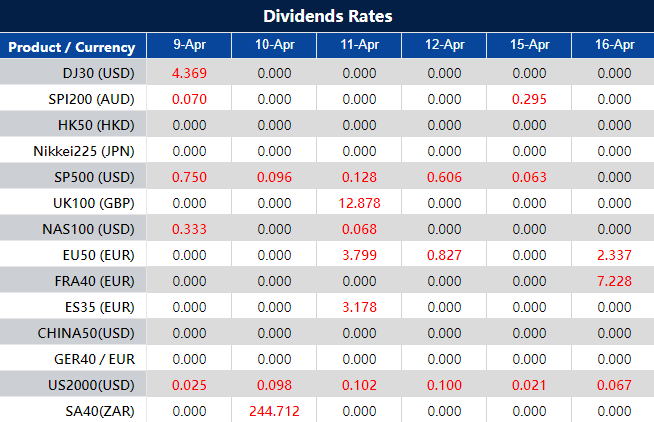

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume ”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact info@vtmarkets.com.

Le trading de CFD comporte un niveau de risque élevé et peut ne pas convenir à tous les investisseurs. L'effet de levier dans le trading de CFD peut amplifier les gains et les pertes, dépassant potentiellement votre capital initial. Il est crucial de bien comprendre et reconnaître les risques associés avant de négocier des CFD. Tenez compte de votre situation financière, de vos objectifs d’investissement et de votre tolérance au risque avant de prendre des décisions commerciales. Les performances passées ne préjugent pas des résultats futurs. Reportez-vous à nos documents juridiques pour une compréhension complète des risques liés au trading de CFD.

Les informations contenues sur ce site Web sont générales et ne tiennent pas compte de vos objectifs individuels, de votre situation financière ou de vos besoins. VT Markets ne peut être tenu responsable de la pertinence, de l'exactitude, de l'actualité ou de l'exhaustivité de toute information du site Web.

Nos services et informations sur ce site Web ne sont pas fournis aux résidents de certains pays, notamment les États-Unis, Singapour, la Russie et les juridictions répertoriées sur les listes du GAFI et des sanctions mondiales. Ils ne sont pas destinés à être distribués ou utilisés dans un endroit où une telle distribution ou utilisation contreviendrait à la loi ou à la réglementation locale.

VT Markets est une marque avec plusieurs entités autorisées et enregistrées dans diverses juridictions.

· VT Markets (Pty) Ltd est un fournisseur de services financiers (FSP) agréé enregistré et réglementé par la Financial Sector Conduct Authority (FSCA) d'Afrique du Sud sous le numéro de licence 50865.

· VT Markets Limited est un courtier en investissement agréé et réglementé par la Mauritius Financial Services Commission (FSC) sous le numéro de licence GB23202269.

VT Markets Ltd, enregistrée en République de Chypre sous le numéro d'enregistrement HE436466 et dont le siège social est situé à l'Archevêque Makarios III, 160, étage 1, 3026, Limassol, Chypre, agit uniquement en tant qu'agent de paiement pour VT Markets. Cette entité n'est ni autorisée ni agréée à Chypre et n'exerce aucune activité réglementée.

Copyright © 2025 Marchés VT.