Forex orders are an essential part of the trading process. An order is a request to buy or sell a currency at a given price. The type of order you use can affect how quickly you get your desired currency and how much you pay.

This lesson will teach us about the different types of forex orders.

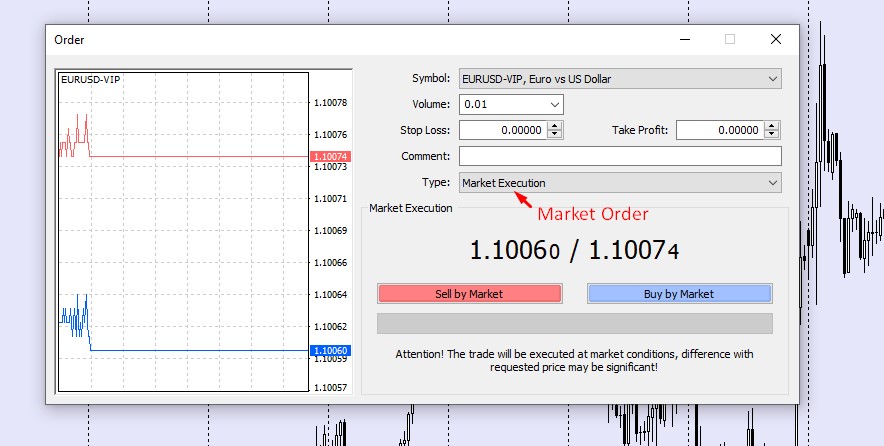

Market Order

A market order is a direct execution. Once you see the price you want, click buy or sell in your platform’s order window.

Source: VT Markets MT4

If you think the price will go up and you want to buy, click “Buy by Market.”

You must remember though that you might get a slippage if you buy something on the market.

What is slippage?

Slippage refers to the contrast between the expected price of a trade and the price at which it was executed. The term is used in all trading markets but is most common in Forex and futures markets.

This difference can be due to many factors, such as market volatility, liquidity issues, or high-frequency trading. Slippage can also occur when there are too many orders to fill at one time.

For example:

Let’s say the price is 0.71533, and you want to sell at that price. When you click “Sell by Market”, you would expect the same price at 0.71533. But because of slippage, you’ll get 0.71534 instead, which is slightly better. This is because the market moves so quickly that the price already shifted when you clicked.

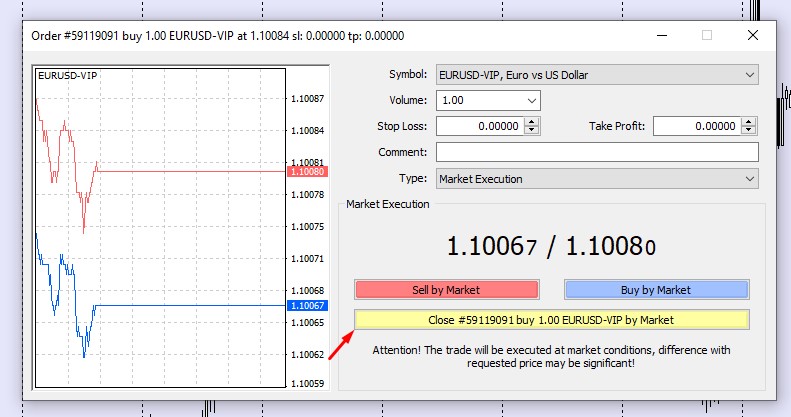

To close a position using the market order, you can open the same order page by clicking on the open position in the terminal section on the MT4. The exact order page will open up.

Source: VT Markets MT4

The image above says, “Close #18501322 sell 1.00 AUDUSD-ECN by Market” in yellow. Click on that, and remember that when you close a Sell position, you will get the Ask price, which is, in this case, 0.71504 (take note that it may get slippage too).

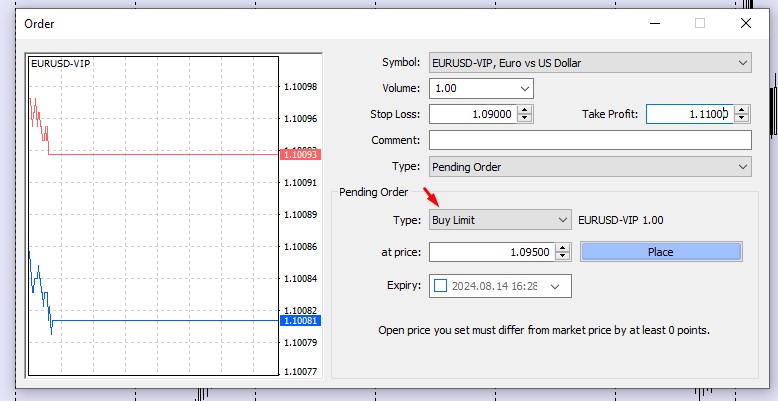

Limit Order

A limit order is a pending order you place when seeking a better entry price. There are two options: Buy Limit and Sell Limit.

Source: VT Markets MT4

Buy Limit Order – Set a Buy Limit if you wish to buy below the current price.

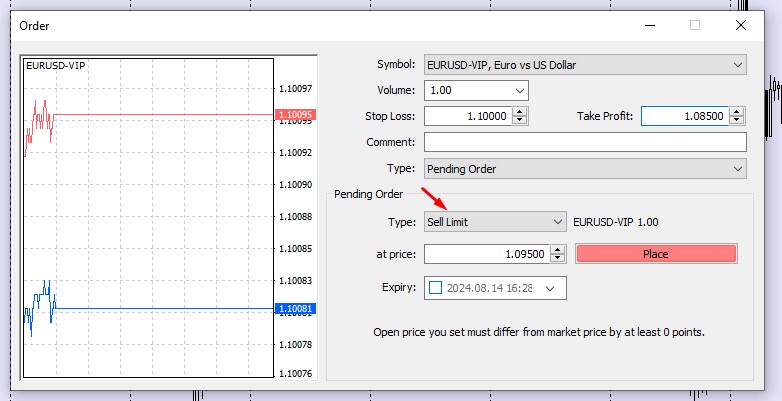

Source: VT Markets MT4

Sell Limit Order -Set a Sell Limit if you want to sell above the current price.

For example, if the market is moving in a range, you may notice that they always rebound at similar price levels.

As shown in the illustration, the price always bounces back up when it reaches a lower level and then falls when it comes to a higher level.

After some research, you might find out that this range movement will continue for some time, and you wish to benefit from it.

The price is now trading in the midway of those levels. So, rather than waiting for the price to reach those levels, you can set a Sell limit at the higher level or a Buy limit at the lower level.

Consider the following example:

Source: VT Markets MT4

As you can see from this chart, there is a range movement with some higher and some lower highs and lows.

It also shows that the price is currently moving in the middle. Supposing you want to open a buy position, but you want to buy near the lower levels. So you decide to put a Buy Limit Order above the lower levels.

Source: VT Markets MT4

After the price moves, as shown in the chart above, you may have correctly analyzed it. Your Buy Limit Order has converted to a Buy Order automatically.

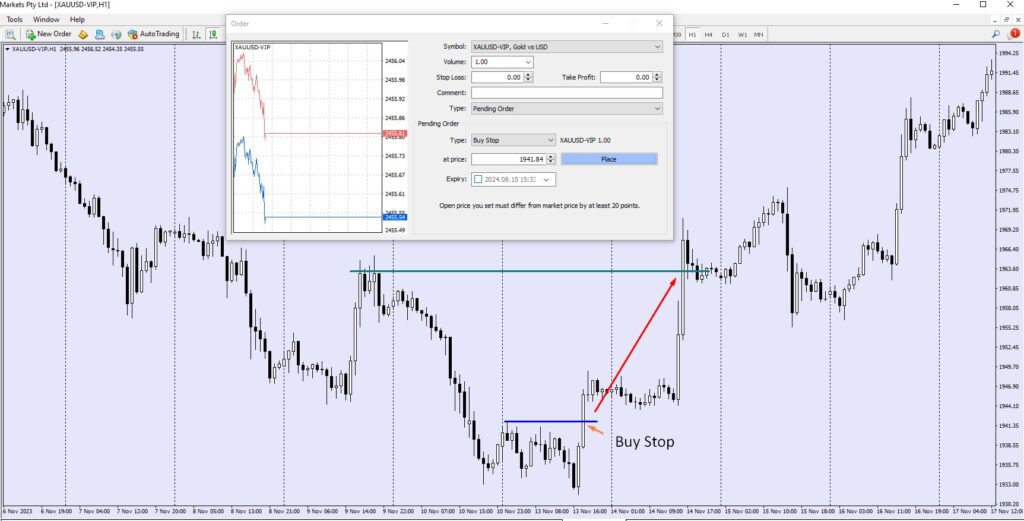

Stop Order

A stop order is a pending order that you place when you feel a particular price will result in market continuation. There are two options:

- Place a Buy Stop if you want to buy above the current price.

- Place a Sell Stop if you want to sell below the current price.

Source: VT Markets MT4

As a result, when the price reaches specified levels, the position will automatically open for Buy or Sell at a price stated in the orders.

Therefore, if we look at the sample above, we can see a ranging movement and two borders, one higher and one lower. That border will eventually be broken if the price begins to trend.

After some analysis, you concluded that if the price breaks through the upper border, it will continue to rise until it reaches the target level. Thus, you can place a Buy Stop order above the higher border, assuming that you will automatically open a Buy position if the border breaks. If the market continues to rise, you will profit.

You may also have determined that if the price breaks through the lower border, it will continue to rise until it reaches the target level. Therefore, you can place a Sell Stop order for this below the lower border, assuming that if the border breaks, you will automatically open a Sell position. If the market continues to decline, you will profit.

Source: VT Markets MT4

Consider the following example:

Source: VT Markets MT4

As you can see from this chart, there is a range movement with some higher and some lower highs and lows.

Assuming that the price would rise when it breaks through the higher levels, you place a Buy Stop Order above the higher levels.

Source: VT Markets MT4

After the price moves in the way shown in the chart above, you may have correctly analyzed it. Your Buy Stop Order has converted to a Buy Order automatically.

These higher and lower levels are commonly referred to as Support and Resistance Levels, which will be tackled in the next lesson.