On Wednesday, US stocks rebounded, led by technology stocks, as the Federal Reserve chose to maintain interest rates, easing concerns of an imminent rate hike. The Dow Jones, S&P 500, and Nasdaq Composite all posted gains, with technology stocks like AMD, Micron Technology, and Nvidia leading the charge. The Federal Reserve’s decision also led to a drop in Treasury yields and boosted equity markets. The US dollar strengthened despite lower yields, supported by Fed Chair Jerome Powell’s stance against rate cuts and mixed economic data. The currency market saw the USD/JPY pair decline, the euro (EUR/USD) struggle, the British pound (GBP) face challenges, and the Australian dollar (Aussie) rise. Looking ahead, economic data and central bank meetings will continue to shape market dynamics.

Stocks rebounded on Wednesday, following a challenging three-month period, after the Federal Reserve decided to keep interest rates unchanged for the second consecutive time, leading investors to believe the central bank would maintain its current stance for the remainder of the year. The Dow Jones Industrial Average rose by 221.71 points (0.67%) to 33,274.58, the S&P 500 increased by 1.05% to 4,237.86, briefly crossing its 200-day moving average, and the Nasdaq Composite gained 1.64% to reach 13,061.47. Information technology stocks were the standout performers, with gains of approximately 2%. Notable semiconductor companies like Advanced Micro Devices and Micron Technology saw significant increases of 9.7% and 3.8%, respectively. Nvidia shares also rose by more than 3%.

The Federal Reserve decided to maintain rates in the range of 5.25% to 5.5%, in line with expectations. The central bank reported that economic activity had expanded strongly in the third quarter, suggesting robust growth. While the recent rise in yields has reduced the likelihood of a rate hike in December, Fed Chair Jerome Powell did not completely rule out the possibility, indicating that it may not be difficult to raise rates after pausing for two meetings. Bond yields fell following the rate decision and the Treasury’s bond sale plans, which provided a boost to equities. The 10-year Treasury yield dropped below 4.8% after reaching above 5% in October, which had caused concerns in the markets.

Data by Bloomberg

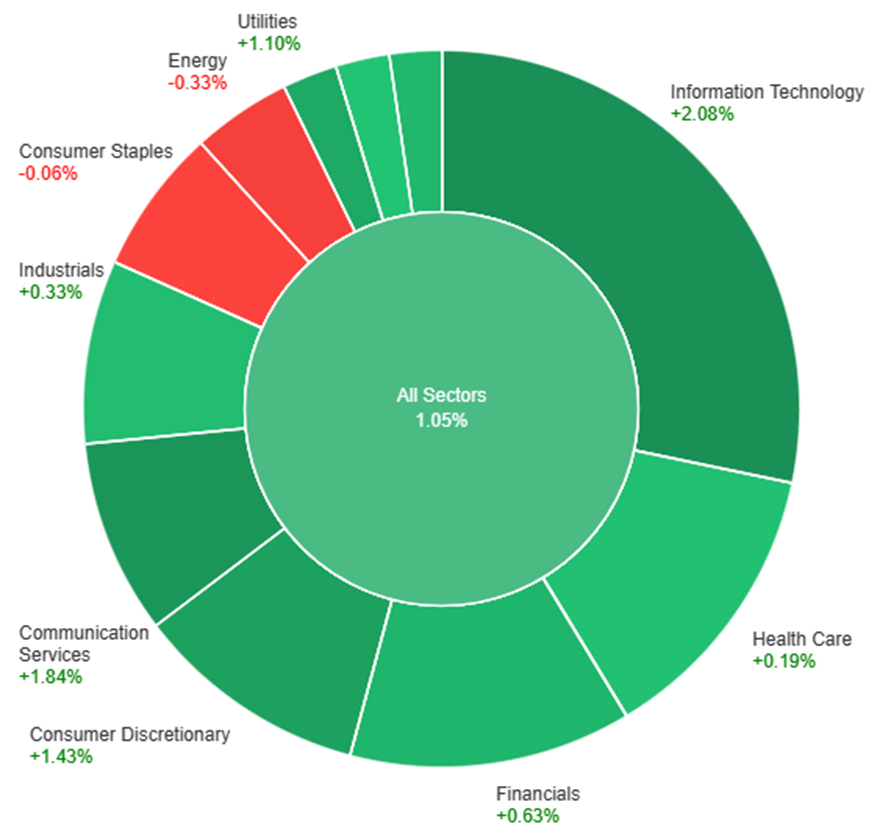

On Tuesday, the overall market saw a positive trend, with all sectors collectively rising by 1.05%. Among the top-performing sectors, Information Technology led the way with a substantial increase of 2.08%, followed by Communication Services at 1.84% and Consumer Discretionary at 1.43%. Meanwhile, Consumer Staples and Energy were the only sectors that experienced declines, with decreases of -0.06% and -0.33%, respectively. The rest of the sectors showed modest gains, contributing to the overall positive market performance.

In the latest currency market updates, the US dollar experienced a 0.39% increase, despite a notable drop in Treasury yields. This surge came after the Federal Reserve’s decision to maintain its policy of keeping interest rates high for an extended period. Fed Chair Jerome Powell also clarified that there had been no discussions about rate cuts at this point. Prior to the Fed’s statement, the US dollar had seen a slightly stronger performance. However, it encountered resistance due to the pullback in USD/JPY and dovish reactions to disappointing US economic data, as well as the Treasury refunding announcement, which had pushed Treasury yields lower. Notably, ADP reported only 113k job additions, falling short of the forecasted 150k, and the combined readings for September and October were the weakest since January 2021. The ISM manufacturing data also unexpectedly slipped further into contraction, possibly influenced by the earlier UAW strike, which has since been resolved. On a positive note, the JOLTS report revealed an unexpected tightening of the labor market, with an increase in job openings and a decrease in layoffs to a 9-month low. These developments, combined with Tuesday’s data from the NY Fed’s MCTI, indicating persistent inflation, raised questions about whether the drop in Treasury yields was an overreaction, especially considering the Treasury’s refunding announcement showed a slower pace of issuance increases.

In the context of global currency dynamics, the USD/JPY pair experienced a 0.47% decline following a post-BoJ meeting surge that fell short of the 32-year peak reached in 2022 due to Japanese intervention warnings. The euro (EUR/USD) saw a 0.3% decrease, with the lower 10-day Bolli and last week’s low putting pressure on it, regardless of the fall in Treasury yields. This decline was triggered by downbeat Chinese manufacturing data, which raised concerns for the eurozone, particularly Germany, given its reliance on Chinese business. The British pound (GBP) also fell by 0.16%, remaining close to October’s lows as policymakers faced a dilemma ahead of the Bank of England (BoE) meeting. The BoE is grappling with the challenge of managing the UK’s high inflation rate of 6.7% alongside indications of economic stress. On a positive note, the Australian dollar (Aussie) saw a 0.7% rise, benefiting from higher equities. Looking ahead, Thursday is expected to bring additional economic data, including Challenger layoffs, jobless claims, unit labor costs, and durable orders, with Friday’s jobs data and ISM non-manufacturing figures on the horizon. These factors collectively shaped the currency market’s landscape, with the US dollar’s resilience against various headwinds being a notable highlight.

EUR/USD Faces Uncertain Outlook as ECB Maintains Rates and Eurozone Economic Indicators Signal Recession Risks

The European Central Bank (ECB) opted to keep interest rates steady last week, but expectations of rate cuts in Q2 next year persist due to disinflationary pressures resulting from sluggish GDP growth and concerning PMI data. In addition, recent economic indicators in the Eurozone, such as the preliminary HICP and GDP figures, painted a challenging picture with lower-than-expected readings, raising concerns about the possibility of a recession. Traders are keeping an eye on upcoming data releases and ECB communications, while the US Nonfarm Payrolls report on Friday is poised to influence the direction of the EUR/USD pair, with an estimated 180K job additions in October.

According to technical analysis, the EUR/USD moves higher on Wednesday, approaching the middle band of the Bollinger Bands. Currently, the EUR/USD is trading above the middle band, indicating the potential for a slightly higher movement to reach the upper band. The Relative Strength Index (RSI) is at 54, signaling that the EUR/USD is in neutral bias.

Resistance: 1.0616, 1.0705

Support: 1.0500, 1.0405

XAU/USD Faces Mixed Signals Amid Weaker Chinese Data and Upcoming US Employment Figures

In the gold market, the weaker Chinese economic data poses a potential challenge, as the world’s largest gold producer and consumer experiences a drop in manufacturing PMI. However, the focus is now shifting to the upcoming US employment data, with initial jobless claims expected to rise and the Nonfarm Payrolls report on Friday projected to add jobs in October. These events hold the key to determining the direction of gold prices in the near term.

According to technical analysis, XAU/USD is moving in consolidation on Wednesday and was able to reach the narrow lower band of the Bollinger Bands. Presently, the price of gold is consolidating near the middle band, creating a possibility to push back lower. The Relative Strength Index (RSI) is currently at 50, indicating a neutral bias for the XAU/USD pair.

Resistance: $1,992, $2,007

Support: $1,977, $1,962

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CHF | CPI m/m | 15:30 | 0.1% |

| GBP | BOE Monetary Policy Report | 20:00 | |

| GBP | Monetary Policy Summary | 20:00 | |

| GBP | MPC Official Bank Rate Votes | 20:00 | 2-0-7 |

| GBP | Official Bank Rate | 20:00 | 5.25% |

| USD | Unemployment Claims | 20:30 | 210K |